By Daniel McCue

Originally posted on the Joint Center for Housing Studies at Harvard University

Piling on top of steep jumps over the past year, both mortgage interest rates and home prices rose again in mid-2023, further eroding affordability for homebuyers and leaving all but the highest-income households able to afford the mortgage payments for a median-priced home in a growing number of the country’s metros.

Propped up by an historically low number of homes for sale, the median existing home price rose in 171 of 177 metro areas in the second quarter of 2023, according to the National Association of REALTORS®, with prices in the typical metro increasing 9 percent during the quarter.

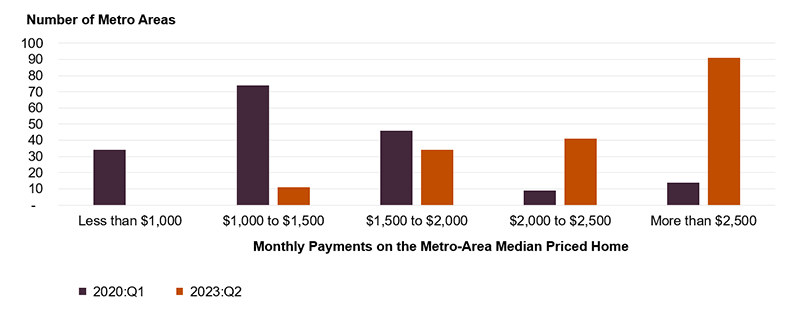

Meanwhile, mortgage rates also creeped up from the first to the second quarter, from 6.37 percent to 6.51 percent, and continued to move higher in the third quarter, topping 7 percent since mid-August. These increases have sent the costs of homeownership to new heights for mortgaged buyers. Assuming a 30-year mortgage, the 3.5 percent downpayment commonly used by first-time buyers, and adding in property taxes and insurance costs, monthly payments on the median-priced home hit new record highs in 159 of the 177 NAR markets in the second quarter of 2023. In the median metro, monthly homeowner costs hit $2,500 in the second quarter of 2023, which was an increase of $750 per month since interest rates began their ascent last year. Monthly payments are now over $2,000 in most metro areas (Figure 1).

FIGURE 1: MONTHLY PAYMENTS ON THE MEDIAN PRICED HOME ARE NOW OVER $2,000 IN MOST METRO AREAS

Notes: Monthly payments include mortgage payments and assumptions of 0.85% mortgage insurance, 0.35% property insurance, and average metro area property tax rates. Home prices and interest rates are from Q2 2023. Mortgage estimates assume 3.5% downpayment on a 30-year fixed rate loan with zero points and a 6.51% interest rate.

Sources: Harvard Joint Center for Housing Studies tabulations of Freddie Mac, Primary Mortgage Market Surveys; NAR, Metro Area Median Single Family Home Sales Prices; and US Census Bureau, 2021 American Community Survey 1-Year Estimates.

Rising costs have pushed homebuying out of reach for all but the highest income households in a growing number of metros. In the typical metro in the second quarter of 2023, a homeowner needed an annual income of at least $99,600 to be able to afford monthly housing payments, up from $52,600 just three years earlier. Indeed, in nearly half (48 percent) of all metros, an annual income of at least $100,000 was required to afford payments on the median-priced home (Figure 2). Back in the first quarter of 2020, an income of $100,000 or more was required to afford the median home in just 7 percent of all metros.

FIGURE 2: HIGH INCOMES NEEDED TO PURCHASE HOMES

With increasing numbers of buyers blocked by this high hurdle of affordability, existing home sales have tumbled. Sales in August were down 15 percent over the past year and more than 30 percent below peak levels in 2021. For policymakers and practitioners, these declines represent fewer first-time buyers, particularly those with modest means for whom homeownership might help build wealth and reduce growing inequalities compared to higher wealth households who already receive the benefits of homeownership. The declines also mean fewer people reached by downpayment assistance programs and special purpose credit programs that can make homeownership more affordable to disadvantaged groups and reduce persistent racial gaps in homeownership.

Trends in homeownership affordability don’t just affect would-be homebuyers. The millions of households priced out of homeownership must look to rental markets for housing, and affordable rental units have also become increasingly difficult to find over the last few years with the increase in rents and decrease in low-rent housing stock. All this underscores the need for more affordable housing options for both homeowners and renters of modest incomes.